ASIACHEM: China’s Coastal PDH & Ethane Cracker benefits from Panama Canal expansion

By the end of June 2016, the newly-expanded Panama Canal opened commercially. The canal mainly service in Asia - US East Coast and Gulf shipping lines. Currently, China’s coastal imported propane mainly from US and Middle East. Shipping of propane and other hydrocarbon gas liquids (HGL) generally carried by most Very Large Gas Carriers (VLGC). After the expansion, VLGC can across from the new and larger Panama Canal directly, it is expected that the voyage from the US to China can be shortened by about 15 days, the cost for importing North America propane will reduce by about 120CNY/t.

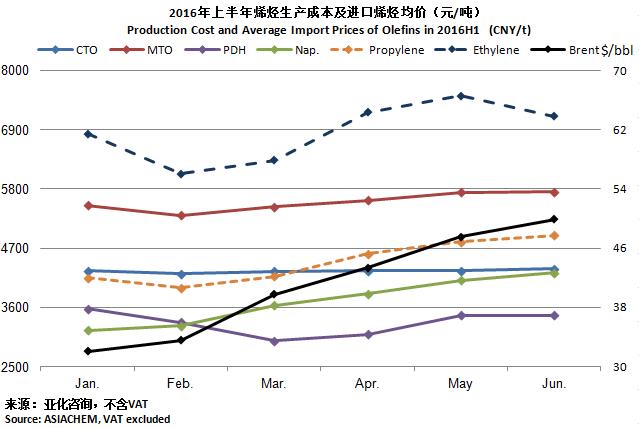

ASIACHEM believes that the completion of the Panama Canal expansion, will benefit Chinese coastal PDH projects, and will also enhance the competitiveness of ethane cracker projects, even bring substantial positive for US LNG exports. Panama official forecast that about 25Mt/a LNG transport will through the new canal by 2020. In recent years, the breakthrough of olefins technologies and diversification feedstock supply, resulting in rapid development of Chinese coal to olefins (CTO), methanol to olefins (MTO), propane dehydrogenation (PDH) projects, the share in total olefins capacity keep increasing year after year. PDH dominated the fastest growth in propylene. ASIACHEM data shows that, by the end of June 2016, Chinese propylene capacity of PDH projects has reached 3.77Mt/a, accounting for about 15% of total propylene capacity. With the operation of PDH projects, Chinese propane imports keep growing in the last two years. The first half of 2016, China imported 5.706Mt of propane, an increase of 59%, mainly from the US, the United Arab Emirates, Qatar, etc. The average import price of 2479CNY/t, dropped of 33% compared to the same period of last year. According ASIACHEM’s technical and economic model, in the first half of 2016, the cost of Chinese typical CTO, MTO, PDH and naphtha cracking project is shown below.

In 2014, Oriental Energy and Caofeidian Industrial Zone Management Committee signed an investment agreement, planning to construct two sets of 1Mt/a ethane cracker and downstream projects such as PE, two sets of 660kt/a PDH and downstream projects such as PP in Caofeidian chemical industrial park; as well as two 50kt grade berths and LPG storage project. Industrial layout of Oriental Energy in China is very clear, in addition to Caofeidian, phase Ⅰ of Zhangjiagang 2*600kt/a PDH project has put into operation in the second quarter of 2015, phase Ⅰ of Ningbo Fuji Petrochemical 2*660kt/a PDH project is expected to put into operation in the second half of this year, and the phase Ⅱalso proceed smoothly. Olefins Feedstock & Technologies Innovation Forum 2016 will be held in Beijing Aug. 25-26. Caofeidian Chemical Industry Park and Oriental Energy will attend, and introduce “Olefins Innovation & the Integration of Chemical Industry Park” and “Innovative Ethane Cracking Project Planning”. An industrial visiting to Caofeidian petrochemical industrial park will be arranged.